Student Finance Guide UK 2025

Navigating UK student finance can feel overwhelming. With average graduate debt reaching around £45,600 (2022/23), understanding your loan is more crucial than ever. This comprehensive Student Finance Guide UK 2025 is designed to demystify the system. We'll break down everything from loan types and application processes to repayment plans and recent policy changes. Discover practical tips and resources to manage your student debt and make informed financial decisions confidently.

UK Student Finance: Who Are the Governing Bodies?

Your student loan is managed by a specific governing body depending on where you ordinarily live when you apply for student finance (not necessarily where you study). Pre-1998 loans may be managed by private companies.

Student Finance England (SFE)

If you normally live in England, Student Finance England (SFE) typically handles your loan application and repayments. They provide online portals for managing your account. Visit SFE.

Student Finance Wales (SFW)

For students normally living in Wales, Student Finance Wales (SFW) manages loan processes. Similar to SFE, they offer online account management. Visit SFW.

Student Awards Agency Scotland (SAAS)

Scottish students (and eligible EU students studying in Scotland) will deal with the Student Awards Agency Scotland (SAAS) for funding and loan management. Visit SAAS.

Student Finance NI (SFNI)

If you're from Northern Ireland, Student Finance NI is your point of contact for loan applications, information, and repayments. Visit SFNI.

How Student Loan Repayments Work: Key Facts

Understanding the core mechanics of how UK student loans are repaid is vital. Here are the essential points:

- Repayment Threshold: You only start repaying your loan once your income goes over a specific annual (and equivalent monthly/weekly) threshold. This threshold varies depending on your loan plan.

- The 9% Rule (or 6%): For most undergraduate loans (Plans 1, 2, 4, 5), you repay 9% of your income above the threshold. For Postgraduate Loans, it's 6%.

- Interest Accrual: Interest starts being added to your loan from the day your first payment is made to you or your university. It continues to accrue even if you're not currently earning enough to make repayments. Interest rates vary by plan.

- Automatic Deductions (PAYE): If you're employed, repayments are usually taken automatically from your salary by your employer through the Pay As You Earn (PAYE) system, just like tax and National Insurance.

- Self-Assessment (Self-Employed): If you're self-employed, you'll declare your income through a Self-Assessment tax return, and HMRC will calculate your repayments.

- Loan Write-Off: If you haven't fully repaid your loan after a certain number of years (e.g., 25, 30, or 40 years, depending on the plan), the remaining balance is typically written off.

The 5 Repayment Plans

In the United Kingdom, there are five student loan plans: Plan 1, Plan 2, Plan 4, Plan 5 and Postgraduate loans. You can be on more than one plan at a time i.e. Plan 2 and Postgraduate, in which case there can be slight overlaps in how you repay your loan. Read more on overlapping plans.

Plan 1 Loans: Plan 1 loans are designed for students who started their undergraduate courses between 1998 - and September 2012. Under Plan 1, repayments begin once the borrower's annual income exceeds £26,065. They will be expected to repay 9% of any income over this threshold. The interest rate is determined by either the Bank of England base rate plus 1% or the rate of inflation, whichever is lower. Plan 1 loans are automatically written off after 25 years if the first loan was taken on or after September 1, 2006; otherwise, the loan is written off when the borrower turns 65.

Plan 2 Loans: Plan 2 loans apply to students who started their undergraduate

studies after

September 1, 2012. Repayments begin when the borrower's income surpasses £28,470 per year, with

repayments

amounting to 9% of income above the threshold. The interest rate follows the Retail Prices Index

(RPI) plus

a percentage. The percentage is worked out depending on your earnings (example below) however

it's

currently

capped at 7.3%. Plan 2 loans are automatically written off after 30 years starting in April

after

graduation.

Practical example:

- If you earn less than or equal to £28,470/year. Interest rate = RPI

- If you earn over £49,130/year. Interest rate = RPI + 3%

- If you earn between £27,296 to £49,130. The extra on top of the RPI moves from 0% to 3%. For

example, earn

£38,213 which is halfway and your rate will be RPI + 1.5%.

Plan 4 Loans: Plan 4 loans are for students applying to the Student Awards Agency Scotland. The repayment threshold for Plan 4 loans is £32,745 per year, with borrowers repaying 9% of income over this threshold. The interest rate on Plan 4 loans is 4.3%. Plan 4 loans are automatically written off 30 years after April the borrower was first due to repay if the first loan was taken on or after August 1, 2007; otherwise, the loan is written off when the borrower turns 65 or after 30 years from the April they were first due to repay, whichever comes first.

Plan 5 Loans: Introduced for students beginning courses on or after August 1, 2023, Plan 5 loans offer repayment terms tailored to the needs of eligible students. The repayment threshold for Plan 5 loans is £25,000 per year, with borrowers repaying 9% of income over this threshold. The interest rate on Plan 5 loans is the same as the RPI% is unless capped. The biggest difference with Plan 5 loans is they are automatically written off 40 years after the April the borrower was first due to repay as opposed to 30 years for most other plans.

Postgraduate Loans: Postgraduate loan plans are aimed at students pursuing Master's or Doctoral courses. The repayment threshold for Postgraduate Loan Plans is £21,000 per year, with borrowers repaying 6% of income over this threshold. The interest rate on Postgraduate Loan Plans is RPI% + 3% unless capped. Postgraduate loan plans are automatically written off 30 years after the April the borrower was first due to repay.

Repayment Plan Summary

| Plan type | Yearly threshold | Monthly threshold | Weekly threshold | Interest rate |

|---|---|---|---|---|

| Plan 1 | £26,065 | £2,172 | £501 | 4.3% |

| Plan 2 | £28,470 | £2,372 | £547 | 7.3% |

| Plan 4 | £32,745 | £2,728 | £629 | 4.3% |

| Plan 5 | £25,000 | £2,083 | £480 | 4.3% |

| Postgraduate Loan | £21,000 | £1,750 | £403 | 7.3% |

Managing Repayments for Multiple Student Loans (Overlapping Plans)

It's common for students to have more than one type of student loan, especially if they've pursued further studies like a Master's degree or returned to education. Understanding how repayments work when you have overlapping plans is key to managing your finances.

Essentially, the calculation depends on whether a Postgraduate Loan is involved.

Scenario 1: Multiple Undergraduate/Previous Loan Plans (No Postgraduate Loan)

If you have loans from different undergraduate plans (e.g., a Plan 1 and a Plan 2 loan, or two Plan 2 loans from different courses) but no Postgraduate Loan, the rule is straightforward:

- You will make a single monthly repayment.

- This repayment is calculated as 9% of your income above the lowest repayment threshold among all your active non-postgraduate loan plans.

- If you have more than one student loan of the same plan type, student finance will split the payment between your loan accounts. It is important to remember that this could mean one loan reaches 0 before the other(s). If this happens you will need to inform Student Finance England so they can consolidate future payments into the remaining loans.

Example:

Suppose you have both a Plan 1 loan (monthly threshold £2,172) and a Plan 2 loan (monthly threshold £2,372). You earn £2,500 per month.

- The lowest threshold is £2,172 (Plan 1).

- Your income above this lowest threshold is £2,500 - £2,172 = £328.

- Your single monthly student loan repayment would be 9% of 328 = £29.52.

This single payment is then distributed by the Student Loans Company to your different loans.

Example 2:

Suppose you have two Plan 2 loans (monthly threshold £2,372). You earn £2,500 per month.

- The lowest threshold is £2,372 (Plan 1).

- Your income above this lowest threshold is £2,500 - £2,372 = £128.

- Your single monthly student loan repayment would be 9% of £128 = £11.52.

- Your payment will be split between your two loans (£5.76 per loan).

This single payment is then distributed by the Student Loans Company to your different loans.

Scenario 2: Undergraduate Loan(s) AND a Postgraduate Loan

If you have a Postgraduate Loan (Master's or Doctoral) in addition to one or more undergraduate loan plans, you will effectively make two deductions from your pay, calculated as follows:

- 6% of your income above the Postgraduate Loan repayment threshold (currently £1,750 per month / £21,000 per year).

- AND 9% of your income above the relevant undergraduate loan plan threshold (if you have multiple undergraduate plans, it's 9% above the lowest of those thresholds).

These two amounts are added together to determine your total student loan deduction each month.

Example:

Imagine you have a Plan 2 loan (monthly threshold £2,372) and a Postgraduate Loan (monthly threshold £1,750). You earn £2,800 per month.

- Postgraduate Loan repayment:

- Income above PG threshold: £2,800 - £1,750 = £1,050.

- 6% of £1,050 = £63.

- Plan 2 Loan repayment:

- Income above Plan 2 threshold: £2,800 - £2,372 = £428.

- 9% of £526 = £38.52.

- Your total combined monthly student loan repayment would be £63 + £38.52 = £101.52.

It's important to note that even though you have two types of deductions, it will usually appear as a single combined student loan deduction on your payslip if you are employed under PAYE.

Student Loan Repayments with Multiple Jobs

If you're employed in more than one job simultaneously, it's important to understand how your student loan repayments are calculated. The key principle is that repayments are assessed against each job's income individually, not your combined total income from all jobs.

You will only make repayments through a particular job if your earnings from that specific job go above the repayment threshold for your loan plan(s). This means you could have two or more jobs, but only make student loan deductions from one of them, or even none if no single job pays enough.

Example 1: Below Threshold in Both Jobs

Let's say you have a Plan 1 loan (monthly threshold £2,172) and two part-time jobs:

- Job A pays £1,200 per month.

- Job B pays £1,000 per month.

Even though your combined income is £2,200 (which is above the threshold), neither individual job's pay exceeds £2,172. Therefore, you would not make any student loan repayments through PAYE from either job.

Example 2: One Job Above Threshold, One Below

Imagine you have a Plan 2 loan (monthly threshold £2,372) and two jobs:

- Job X pays £2,500 per month.

- Job Y pays £700 per month.

In this case:

- Repayments would be deducted from Job X because its earnings (£2,500) are above the £2,372 threshold. The repayment would be 9% of (£2,500 - £2,372).

- No repayments would be deducted from Job Y, as its earnings (£700) are below the threshold.

Important Note for Self-Assessment: If the total from all your jobs combined takes you over the threshold, but no single job does, and you also have other income requiring a Self-Assessment tax return (e.g., self-employment, significant investment income), HMRC may assess student loan repayments based on your total income through the Self-Assessment process. However, for purely PAYE employment, the individual job rule applies.

Student Loan Repayments for the Self-Employed

If you are self-employed, the process for repaying your student loan differs from those in PAYE employment. Here’s what you need to know:

- Annual Calculation: HM Revenue and Customs (HMRC) will calculate your student loan repayments annually.

- Self-Assessment Tax Return: Your repayments are based on your total income as declared in your Self-Assessment tax return.

- Payment Due Date: Repayments are typically due by the same deadline as your income tax payments (usually 31st January following the tax year).

- Combined Income: If you have both employment income (where PAYE deductions might have already been made for student loans) and self-employment income, HMRC will calculate your total repayment due based on your overall income. Any student loan amounts already paid through PAYE during the tax year will be deducted from the total you owe via Self-Assessment.

It's crucial to accurately report your income to ensure you're repaying the correct amount and to budget for these annual payments.

Repaying Your Student Loan from Overseas

If you plan to live or work abroad for more than three months, your student loan repayments don't stop. You'll need to proactively manage them. Here’s a guide to what’s involved:

- Notify the Student Loans Company (SLC): Before you leave the UK, you must inform the SLC of your plans to go overseas. Failure to do so can lead to penalties or a higher repayment schedule.

- Income Assessment: The SLC will require details of your income while you're abroad. They will use this to calculate your monthly repayment amount.

- Overseas Thresholds: Repayment thresholds for those living overseas differ from UK thresholds and vary by country (they are often split into country groups based on cost of living). You'll repay 9% (or 6% for Postgraduate Loans) of what you earn over the specific threshold for the country you're in.

- Currency Conversion: Your income will be converted to pounds sterling (£) by the SLC to calculate repayments. You'll be responsible for any currency conversion fees or bank charges when making payments.

- Direct Payments: You will need to arrange to make repayments directly to the SLC, usually via direct debit or bank transfer from an overseas account or a UK account.

It's vital to keep the SLC updated with your contact details and income information while abroad to ensure you're meeting your obligations.

Official Overseas Earnings Thresholds:

The UK government publishes the earnings thresholds for making student loan repayments while overseas. These are updated periodically. You can find the latest figures here:

Consequences of Missing Student Loan Repayments

Meeting your student loan repayment obligations as outlined in your loan agreement is a legal requirement. Failing to make repayments when due can have serious consequences:

- Legal Action: The Student Loans Company (SLC) has the authority to take legal action to recover overdue debt. This can include obtaining a court order requiring you to repay the outstanding amount.

- Full Balance Due: A court order might require you to repay the entire outstanding loan balance, including all accrued interest and any penalties, as a single lump sum.

- Additional Costs: If legal action is taken, you could also become liable for all associated costs, such as court fees and legal expenses.

- Impact Regardless of Location: These enforcement actions can apply whether you are residing in the UK or living overseas.

What to do if you've missed payments: If you have missed repayments or are struggling to make them, it's crucial to contact the SLC (or your specific loan administrator) as soon as possible. They can discuss your situation and may be able to offer solutions, such as a revised repayment schedule. Ignoring the issue can lead to more significant problems. The primary goal should be to bring your account up to date and avoid further delinquency.

How to contact Student Finance

To get information that is specific to your situation you will need to get in contact with the governing body you live in (or where the uni resides if you don't live in the UK).

England

Phone: 0300 100 0607

Twitter: @SF_England

Website: Student

Finance England

Northern Ireland

Phone: 0300 100 0077

Website: Student

Finance Northern Ireland

Scotland

Phone: 0300 555 0505

Twitter: @saastweet

Website: Student Awards Agency

Scotland

Wales

Phone: 0300 200 4050

Twitter: @SF_Wales

Website: Student

Finance Wales

Student Finance Company

Student Finance Company

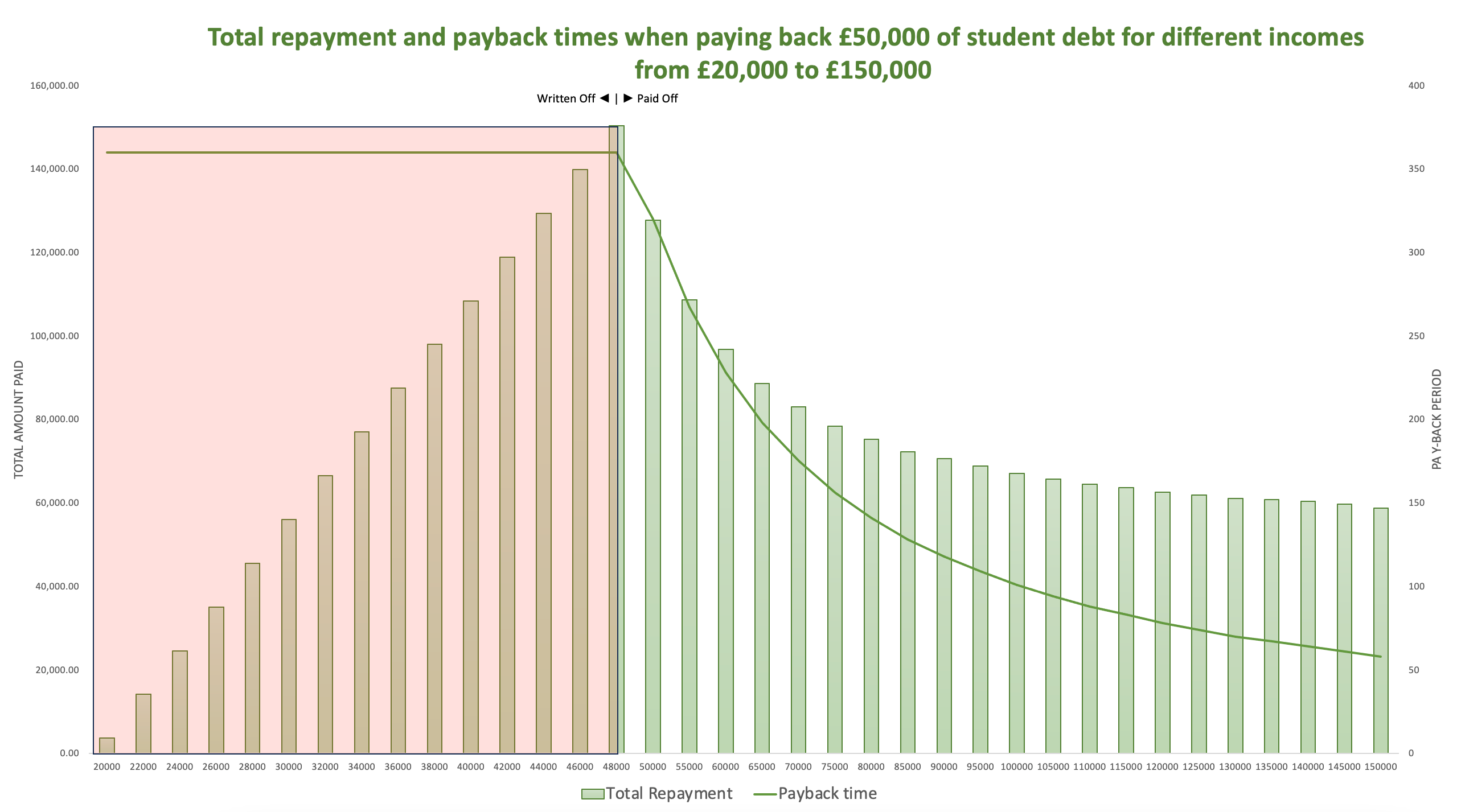

What's the Real Cost of University in the UK?

When considering higher education, one of the first questions is often about the cost. While tuition fees provide a starting point, the actual amount a student repays on their student loan can be vastly different. This section explores how to understand the true financial commitment of a UK university education when student loans are involved.

Beyond Tuition Fees: It's Not Just About the Sticker Price

Current tuition fees in England can be up to £9,250 per year, with slightly different figures in Wales, Scotland, and Northern Ireland often depending on where you're from and where you study. A simple calculation might suggest a 3-year course costs around £27,750 (£9,250 x 3). However, for the majority who take out student loans, this initial figure doesn't represent the amount they'll actually pay back.

Student loans in the UK operate more like a graduate contribution system. Repayments are income-contingent, meaning they depend on how much you earn after graduating, not solely on the amount you borrowed.

Key Factors Influencing Your Repayments

Several elements determine your monthly student loan payments and, ultimately, the total amount you repay over the loan's term:

- Your Income: This is the primary driver. You only repay when you earn above a certain threshold.

- Repayment Threshold: The annual income level you must surpass before repayments begin. This varies by loan plan.

- Repayment Percentage: Typically 9% of your income above the threshold (6% for Postgraduate Loans).

- Interest Rates: Interest is added to your loan, increasing the balance. Rates vary by plan and can change.

- Loan Write-Off Period: After a set period (e.g., 30 or 40 years), any remaining loan balance is usually cancelled.

- Wage Growth: How your salary increases over your career significantly impacts your ability to repay.

- Inflation (RPI): This often influences how repayment thresholds and sometimes interest rates are adjusted annually.

Crucially, because of the write-off mechanism, many graduates will not repay their full loan amount plus all accrued interest. The "cost" of university for them is the sum of all repayments they make before the loan is cancelled.

Simple Example vs. Reality (Plan 5):

Imagine you earn £30,000 per year and are on Plan 5 (threshold £25,000/year). Your income above the threshold is £5,000. Your annual repayment would be 9% of £5,000 = £450 (or £37.50 per month).

If this situation never changed for 40 years (the Plan 5 write-off period), you'd repay £450 x 40 = £18,000. If your initial loan was £45,600, this £18,000 is substantially less.

However, this is too simplistic. Your salary will likely change, as will the repayment threshold due to inflation.

The Impact of Dynamic Factors: A Calculator Example

To illustrate how dynamic factors like wage growth and inflation affect the total repaid, let's use our Student Finance Calculator with the following common inputs for a Plan 5 scenario:

- University Start Year: 2025 (Plan 5)

- Course Length: 4 years

- Student Loan Debt: £45,600

- Initial Annual Salary: £30,000

- (Default assumptions: 4% wage growth, 2% RPI/threshold growth, typical Plan 5 interest)

As you can see from a typical calculator output, while the initial monthly repayment might be around £37.50, the total estimated repayment over the loan term could be significantly higher than the simple £18,000 calculated earlier (£175,658.80 in this example). This dramatic difference is primarily due to:

Why the Difference? Wage Growth and Compounding

Wage Growth: Even a modest average annual wage increase (e.g., 4%) compounds significantly over 30-40 years. A £30,000 starting salary could grow to a much higher figure by the end of the loan term. As your income rises, so do your monthly repayments, leading to a larger total amount repaid over time.

Inflation and Thresholds: Repayment thresholds are generally designed to increase with inflation (often measured by RPI). If your wage growth outpaces the threshold growth, you'll repay more. If thresholds are frozen (as sometimes happens by government policy) while wages and inflation rise, borrowers effectively repay a larger portion of their income, accelerating repayments.

Understanding Thresholds:

Imagine the repayment threshold was £0. You'd pay 9% of your entire income. If you earn £2,000/month, you'd repay £180. Now, if the threshold is £1,500, you only pay 9% on the £500 above it (£45). The higher the threshold (relative to your income), the less you repay each month.

Conclusion: The "Affordability Tax" Perspective

For most graduates who take out student loans, the "cost of university" is effectively what they can afford to repay over the loan term before the remainder is written off. It's less about the initial debt figure and accrued interest (unless you're a very high earner likely to clear the full amount). Many view student loan repayments as a form of "graduate tax" – an income-contingent contribution towards the cost of their higher education.

The Caveat: When Full Repayment is Likely

There's an important exception to the "only pay what you can afford" idea. If your income trajectory, loan amount, and interest rates mean you're projected to repay the entire loan plus accrued interest before the write-off date, then the dynamics change. In such cases:

- The total amount borrowed and the interest rate become highly relevant.

- Making overpayments (paying more than the standard monthly amount) could save you a significant amount in total interest paid by clearing the debt faster.

This scenario often applies to higher earners or those with smaller initial loan balances. Determining if this applies to you requires careful calculation. For more on this, see our article on Paying Student Finance Back Early.

Key Trends in UK Student Finance

The landscape of student finance in the UK is constantly evolving, with significant trends impacting current and future students. Understanding these trends is essential for grasping the broader context of student loans, their affordability, and long-term financial implications.

Escalating Loan Debt

The overall scale of student loan debt in the UK has seen a dramatic increase. Approximately £20 billion is loaned to around 1.5 million students in England each year. As of March 2023, the total value of outstanding student loans surpassed £206 billion. Projections indicate this figure could rise to around £460 billion (in 2023 prices) by the mid-2040s. This growth is largely due to changes in government funding policies, which increasingly rely on student loans to cover both tuition fees and living (maintenance) costs.

Fluctuating Interest Rates

Interest rates are a critical factor in the overall cost of borrowing and the affordability of student loans. The rates applied vary significantly by loan plan:

- Post-2012 Loans (Plan 2, and elements of Plan 5 & Postgraduate): These loans have seen variable interest rates, often linked to the Retail Price Index (RPI) plus a potential additional margin (e.g., up to 3% for Plan 2, depending on income or study status). For instance, rates for some of these loans reached up to 7.5% towards the end of 2023.

- Plan 1 Loans (Pre-2012): Interest rates for these older loans are typically lower, usually set at the Bank of England base rate plus 1%, or RPI, whichever is lower. For example, the rate was around 6% for parts of 2023.

These fluctuating rates directly impact the amount of interest added to a student's loan balance over time.

Average Debt Upon Graduation

Students starting their courses in the 2022/23 academic year were forecast to graduate with an average debt of around £45,600. However, due to recent government reforms (primarily affecting students starting from 2023/24 under Plan 5), this average projected debt for new entrants is expected to be slightly lower, around £42,900.

Despite the large debt figures, government estimates suggest that a significant portion of students may not repay their loans in full. For full-time undergraduates starting in 2022/23, it was estimated that only about 27% would repay their loans completely. This figure is projected to increase to around 61% for students under the new Plan 5 system, largely due to the extension of the repayment period from 30 to 40 years.

Growth in Maintenance Loans

Alongside tuition fee loans, maintenance loans (to cover living costs) form a substantial part of student borrowing. In England alone, the value of maintenance loans paid out to full-time students reached £8.3 billion in the 2021/22 academic year. The increasing reliance on these loans, coupled with rising living expenses, contributes significantly to the overall growth in outstanding student loan debt.

UK Student Loans in International Context

When compared internationally, student loans for higher education in England are among the highest in terms of average amounts borrowed among OECD countries. This highlights the particular financial considerations and challenges faced by students in the UK system, prompting ongoing discussions about policy and reform.

Staying informed about these trends can help students and graduates make more informed decisions about their finances and understand the broader factors influencing their student loan journey.